On March 25th, lecturers from Columbia University’s Wealth Management and Insurance Management Master of Professional Studies programs discussed Digitization and the Relationship Imperative as part of the Frame Your Future event series. Leading the panel was Wealth Management advisor and strategist Philipp Hecker, formerly Global Head of Strategy for JP Morgan. He was joined by Wealth Management lecturer and Chief Development Officer of Hightower Advisors, Matthias Paul Kuhlmey, Wealth Management lecturer and Senior Research Associate for Kitces.com, Meghaan R. Lurtz, Ph.D., and Insurance Management lecturer and Senior Vice President at Marsh-USA, Alejandro Zarate Santovena.

Host Philipp Hecker kicked off the conversation on digitization with a revealing question: “When was the last time you consulted with a human travel agent?”

“The impacts on the Wealth Management industry are being seen in two main areas,” said Matthias Kuhlmey, “especially in the ways we interact with clients, and a lot of it is generational.” He urged those in the wealth management field to consider:

First—the generational shift of household wealth where future clients grew up in a different era. This can be seen not only in how they engage with service providers, but also in the identity they seek to build with their wealth. Research on Millennial investment behavior confirms this. Investment advisors need to support these new clients with a few things:

—Understanding the move to an online presence with the focus on “do it yourself” and 24/7 accessibility

—Big data customization. Said Kuhlmey, “I think of it as the emergence of categories of one; clients want to feel at the center of the engagement.”

—Finally, younger consumers focus on money with meaning versus just return on investment

Second—the growing gap between current advisors and these new clients. Advisors still think in terms of managing money. Wealth Management is destined for a generational clash, unless advisors understand that they need to transform their businesses to a higher value proposition. That means helping clients achieve aspirational goals. It means considering the client’s emotional state around money and its socioeconomic impact.

Modeling the wealth management firm of the future around new forms of engagement

Meghaan Lurtz is a financial psychologist. Hecker asked her, “Why is it important to align investing with human dynamics?

“In my class,” she said, “I help students think about money from a behavioral perspective. We question what that means when considering techniques around investing and the degree of risk—not just what’s on a profit and loss statement, but how does this information make one feel? How does this information impact personal goals?”

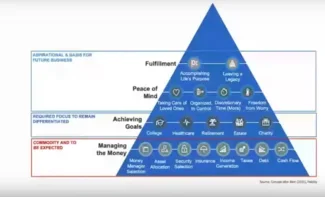

When you look at the pyramid graphic, the lower level is unemotional and then rises to a very emotional high. It says this generation wants to feel good about accruing wealth and using it ethically. For the most part, human beings don’t feel good about their use of money. A key question for younger investors: ‘Is my money doing more than just piling up in a bank account?’

When you look at the lower part of the pyramid, you see the impact digital knowledge can have. But where digital falls short is when it comes to investor aspirations. Advisors need to consider the clients from the bottom up: “managing money” at the bottom through “achieving goals” to “peace of mind,” and finally delivering “fulfillment.”

People make purchases based on emotion, but often without data to support their decisions.

“Future success,” said Kuhlmey, “relies on the bionic advisor, a person who will embrace digitization and technology in order to free up time and shift resources to influence clients’ behavior around matters of wealth.

The theme was picked up by Alejandro Santovena who is enthusiastic about the potential for digitization and personalized products in the commercial insurance space. “We normally personalize programs for very large clients and we have several layers associated with coverage, but today we’re seeing that we can offer customization to smaller customers.”

“For instance, there are new developments in machine learning,” he added, “that match risk appetite with clients. Brokers need to understand which carriers have the appetite for risk that aligns with an individual client. We’ve been exploring tools that allow us to do that. You can also switch it around and use machine learning to surface potential prospects for carriers.”

The implications of digitization in the field of insurance management.

Philipp Hecker asked Santovena, “How far do you see AI going in the commercial insurance space? Does AI have built-in, existing biases?”

“AI is just taking its first steps in the industry,” said Santovena. “Deep learning can revolutionize insurance in the future because it allows for analyses of massive quantities of data, and that allows for cognitive processes when analyzing client business. Regarding bias, it’s a concern; if we’re not careful, we can transfer bias into our algorithms. Algorithms rely on training sets by engineering teams, for instance. Bias means that you start to exclude groups of people. But if you provide oversight, algorithms are easy to retrain and correct.”

Algorithms provide better answers, but humans can be paralyzed by too much choice.

Meghaan Lurtz added, “This is especially true around purchasing insurance. The thinking is, ‘I just had a kid today, I better get insurance, or I’m over 50, I need life insurance.’ What an algorithm can do is identify 2 or 3 choices for a consumer that matches their need. Then it can spit out contact information for who to call. So, for consumers, AI can narrow down the choices to fit the consumer. That’s the best mix of digital technology and human connection.

On the question of how the COVID crisis has influenced behavior, Lurtz added, “We’ve seen the pandemic, a severe weather disaster in Texas, plus fires and social upheaval. These events cause people to think about their financial and personal wellbeing, and that’s good. But when financial decisions are driven by fear, insurance and wealth management decisions happen under pressure. Emotional consulting is the missing piece. When people feel like they’re in a tunnel of fear, brainstorming options becomes impossible. It takes more than sophisticated tools like AI to deliver the right solutions.”

Work with financial planners when the stakes are low.

Panelists concurred that with technology, planners can calculate all possible outcomes—from Plan A to Plan Z. This helps clients think through how each scenario might feel. Things change because the trajectory of life changes. Modeling technology, along with the human interaction, empowers the investor.

“Trust and human interaction are what drive insurance,” said Santovena. “The tools add to that sense of trust. I believe we should fall in love with the problem, not with the technology. The tools help us deliver better answers and build trust. Clients want financial security; that takes a combination of personal attention and technology.”

With digital transformation on the rise, Hecker asked each panelist, “What tips would you offer students who aspire to the fields of Wealth Management and Insurance Management?

Wrapping up with three critical tips.

“Embrace your role as a helping professional. You are being hired for your counsel and that’s a relationship. We need to ask questions, tap into the client’s hopes and fears. Have your client paint a picture about what they want to do in retirement, what their home means to them, or what kind of future they see for their children or their business. The rise in technology frees the planners to concentrate on building a personal alliance with the customer.”

“By all means, wealth management and insurance need to embrace these new technologies. As Matthias was saying, ‘Become a bionic advisor.’ Leverage these new technologies, but with the addition of human interaction. Algorithms will give us insights, but we still need to work toward the best interests of our clients.‘”

“Our industry needs to focus on how we select, evaluate, train, and retain talent. Accepting that digital transformation will continue apace, building trust with clients requires a softer touch at the same time. We will need a diverse, multifaceted group of advisers as we move into the future.”