How do you tell a story of unprecedented global financial fraud committed by an elusive international fugitive?

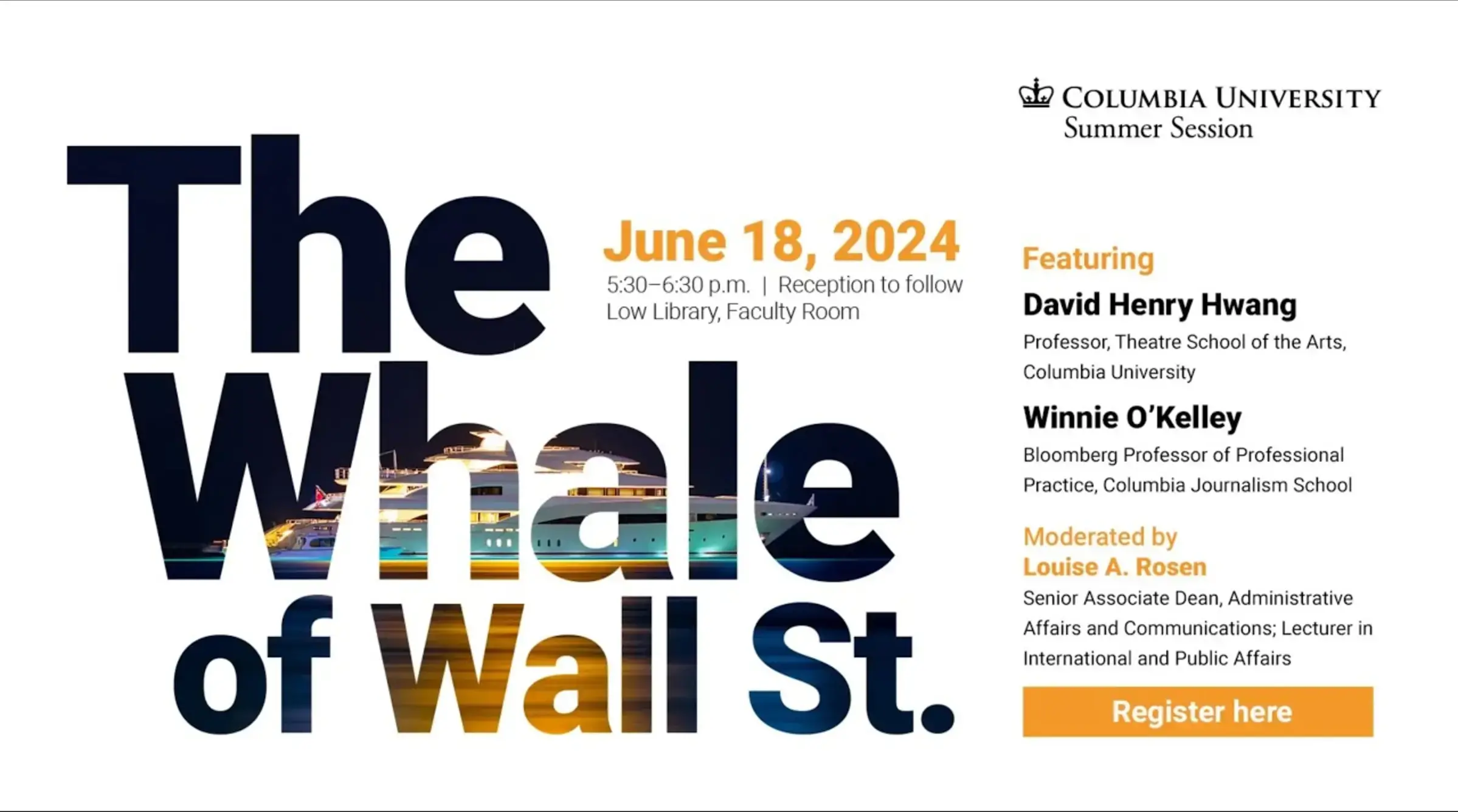

On June 18, Pulitzer Prize–winning editor of The New York Times and Bloomberg Professor of Professional Practice at Columbia Journalism School (JRN) Winnie O’Kelley joined award-winning writer and Columbia Theatre School of the Arts (SOA) professor David Henry Hwang at Columbia University for a conversation about the challenges of chronicling one of the greatest financial frauds in a generation, perpetrated over the course of a decade by a mild-mannered Wharton School graduate and captured in the international bestseller Billion Dollar Whale.

Louise A. Rosen, senior associate dean, administrative affairs and communications at the School of Professional Studies (SPS), and lecturer in the School of Public and International Affairs (SIPA), moderated the discussion, which was part of the Experience Columbia Summer Program. The program features some of the University’s most accomplished faculty, alumni, and industry leaders in intimate discourse around timely themes.

The event was a part of Columbia University’s Summer Session Visiting Students program’s Arts and Culture in NYC and Wall Street Prep: Economics, Finance & Analytics focus areas.

Connecting the Threads of the Fraud

In the late 2000s, Goldman Sachs underwrote a variety of projects in Malaysia worth close to $6 billion, intended to support environmental and commercial development to help the Malaysian people. Instead, O’Kelley learned, this money had been laundered and used for personal gain.

“I remember hearing the story and thinking, something doesn’t smell right,” O’Kelley said.

O’Kelley and her team began to dig deeper when reports surfaced about the surprising behavior of Prime Minister Razak’s wife, Rosmah Mansor. “She was supposedly from a very modest background, going on these incredible shopping sprees with giant jewelry and hundreds of purses. And people wanted to get to the bottom of it.”

Her team kept busy using their skills to ferret out money laundering, fraud, and opaque investments hidden in LLCs created in countries notorious for their lack of transparency. Eventually, they uncovered another key player with some connection to the missing funds: Jho Low, who fully financed Martin Scorcese’s 2013 film The Wolf of Wall Street and was gaining notoriety for his lavish Hollywood parties. Information trickled in, but it took O’Kelley’s team years to connect the threads finally.

Making a Financial Story Compelling

O’Kelley’s team published articles in The New York Times on the scandal in 2015. Concurrently, Tom Wright and Bradley Hope, who reported on the fraud for The Wall Street Journal, compiled enough information to write Billion Dollar Whale in 2018, which became an immediate bestseller. Hollywood took notice and began the search for someone who could adapt it for television.

It was at this point that David Henry Hwang, writer and producer of Showtime’s The Affair, was approached to pen the pilot for a limited series based on its story.

“I read the book and was fascinated by it. But when it comes to numbers and ledgers, my eyes sort of glaze over, so I thought I may not be the best person for this,” Hwang said. He eventually realized that this inclination worked in his favor. He could translate the financial information for a lay audience and draw them in by focusing on what he felt viewers are always interested in: power.

Hwang examined the narrative structure of The Wolf of Wall Street and had an idea. “Leonardo DiCaprio, playing main character Jordan Belfort, narrates the story and early on, has a direct address to the audience that establishes a trust between the viewer and him.” Hwang decided to make Jho Low an unreliable narrator in order to help viewers appreciate how people fall victim to fraud. “By having Jho Low narrate the episodes, we can see things as he wants us to see them until we gradually notice the discrepancies and realize we have been conned.”

Measuring the Human Cost

The conversation then turned to the question of how to illustrate the human cost of this massive financial fraud.

O’Kelley called it Malaysia’s “lost decade” because $6 billion in investment plans that were promised never materialized. However, Hwang shared how difficult it was to convey that loss to the viewer. Their solution: A composite character “who represented some of the people who tried to stop Jho Low to show how ultimately no one was successful in doing so,” Hwang said.

The country’s reaction to the scandal inspired a people-powered revolution that pushed the Prime Minister out of office and into prison, but O’Kelley lamented that this spirit of anti-corruption didn’t last, as Razak’s jail term was recently halved and Goldman Sachs didn’t suffer any significant penalties for their part in the scheme. “It’s important to look at who gets held to account,” she noted.

What the Future Holds

During the Q&A portion of the Experience Columbia event, Hwang was asked what key takeaways he hoped the series would offer viewers. He said he hoped that the series would dramatically demonstrate the real flaws in our financial system. “Seeing [a] character like Leissner from Goldman Sachs taking money from all sides who is not held accountable has a very visceral impact on an audience.”

“Ideally” Hwang offered, “entertainment can be a way to illuminate and create awareness of these sorts of issues.”

O’Kelley was asked if she had any predictions for future trends in financial crimes. She noted that future crimes will likely be connected to exploiting machine learning and AI, and those personas and organizations who are "buying up all of the electrical computing access to power [it].” O’Kelley also noted that hacking will be a big area since so much of what occurs comes from taking information illegally. She also predicted that money laundering will continue to remain a major crime in the future because, as she put it, “that never goes away.”

About Columbia Summer Session

Each summer, Columbia University offers hundreds of courses for Columbia students and students from other domestic and international institutions. Whether on campus or online, Summer term offers the opportunity to study with Columbia’s esteemed faculty, pursue academic interests, advance studies, and prepare for graduate school. Focus areas include Arts and Culture in New York City, Foundations in Pre-Medicine, Public Affairs and Sustainable Futures, and Wall Street Prep: Economics, Finance & Analytics. Learn more about Summer Session at Columbia University.