Columbia University’s Master of Professional Studies in Wealth Management program is taught by elite faculty with deep, applied experience in their respective fields. Four faculty members describe the courses they teach in their own words.

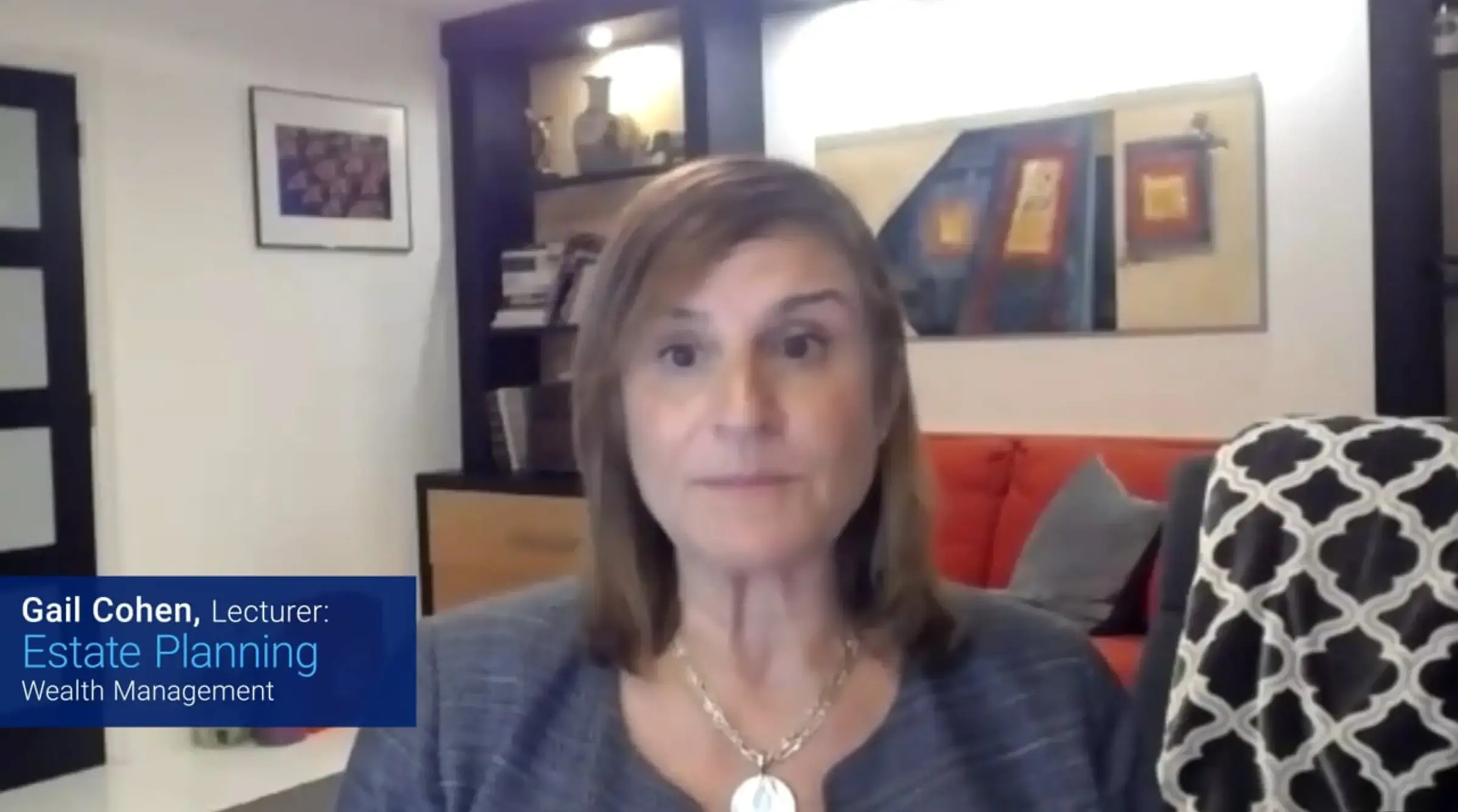

Estate Planning with Gail Cohen

"What are property interests? What are the estate planning documents that people need to gather? In order to understand these questions, you need to understand all the rules behind them." Gail Cohen, J.D., Chair of Fiduciary Trust’s Board of Directors and General Trust Counsel, has over 30 years of experience in the area of trusts and estates. She teaches Estate Planning.

This course examines the key concepts and skills a wealth management professional must understand to support making critical decisions with respect to estate planning. Students will first be introduced to the fundamental characteristics and consequences of property titling, before studying the components of estate planning documentation. This course will explore the various strategies used to transfer property and all of the factors impacting and related to the transfer process, including gift and estate tax compliance and tax calculation, estate liquidity, marital deduction, non-traditional relationships, and the types, features, and taxation of trusts. Students will also explore the various techniques for postmortem estate planning and techniques for intra-family and other business transfers of property.

Investment Planning with Stephen Bodurtha

"Is value investing dead?" Steve Bodurtha has spent his career building investment, wealth management and markets businesses. As the former head of Citi Private Bank’s investment business in North America, Steve led its transformation from a banking and lending dominated business and culture to a leading provider of investment and wealth services to ultra-high net worth clients. He is teaching the course Investment Planning, in which he introduces the primary sources of the field and encourages students to debate the issues these texts raise.

This course introduces basic investment concepts with a focus on planning to address client needs and goals. Students will explore the characteristics, uses, and taxes of various investment vehicles and various investment strategies. They will examine the risk and return and expected cash flows of each asset class (e.g., securities, stocks and bonds) and the tax implications of holding or disposing of them. The course will cover quantitative investment concepts and measures of investment returns. This course will also touch on aspects of portfolio management and introduce at a high level the concept of alternative investments.

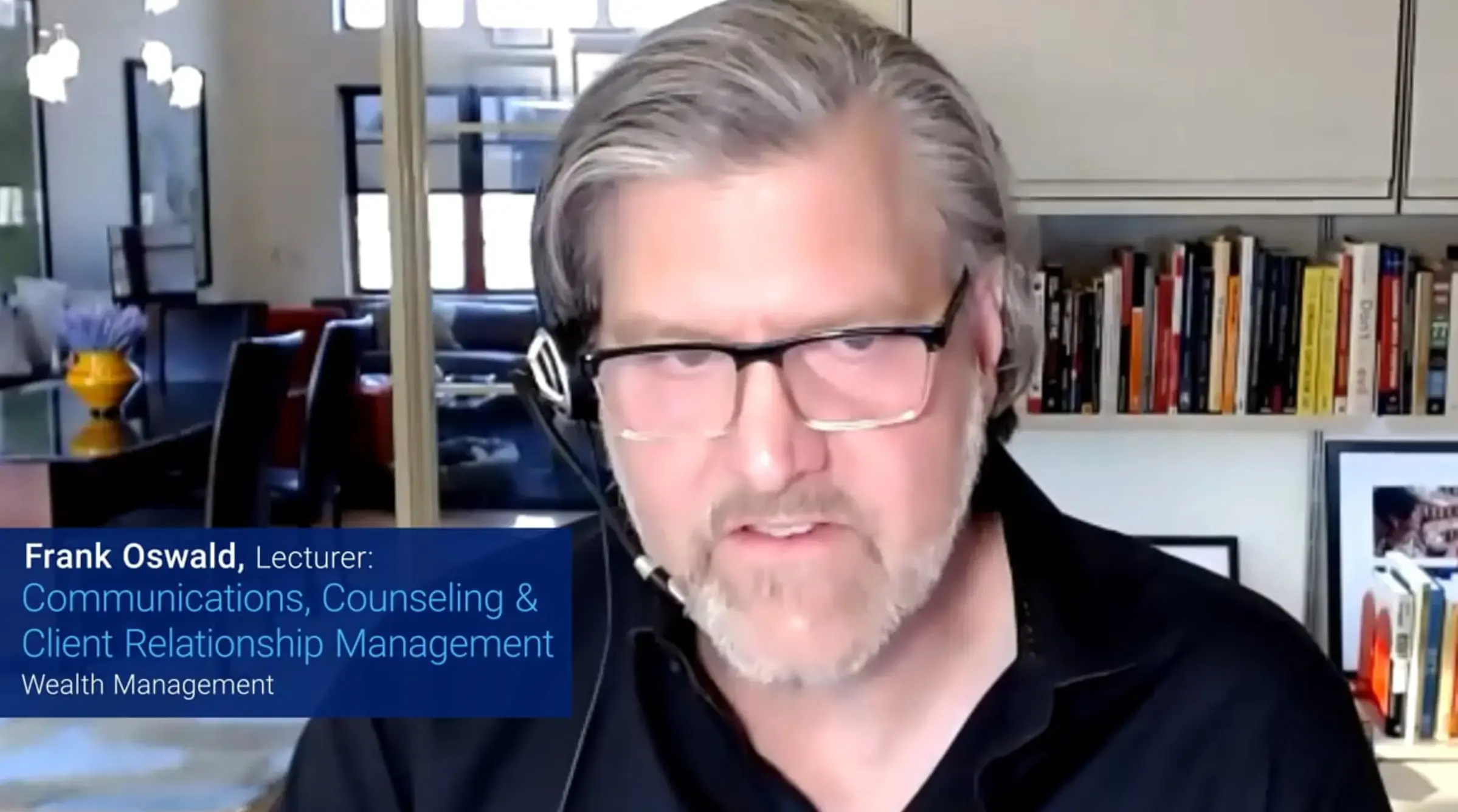

The 3C's: Communications, Counseling, and Client Relationship Management with Frank Oswald

"We learn essential communication and trust-building skills, and culminating and developing personal marketing and communications plans." Frank J. Oswald is an independent communications consultant and writer. He has led the development of corporate, marketing and investor communications for leading companies and organizations for more than four decades. He teaches The 3C's: Communications, Counseling, and Client Relationship Management.

This course focuses on the 3C’s of wealth management: communications, counseling and client relationship management. The first half of the course will focus on both the theoretical foundations as well as best practices associated with client communication and counseling. The overall objective is for the learner to develop a variety of tools to develop deeper relationships with clients through a variety of different communication tools. This case-based course blends both theory and active learning, where students will observe and demonstrate effective oral and written communication within a client-planner interaction.

The second half of the course will focus on client relationship management over the entire life-cycle of the client, from business development to the generational transfer of wealth. Students will develop the necessary skills to both attract new clients as well as to develop deeper relationships throughout the wealth management process.

Students will also learn to analyze their clients and structure persuasive, ethical, and compelling messages in written and verbal channels. In addition, this course will discuss how technology is utilized to better connect with clients including the ability to integrate reporting, analytics, and performance to provide more sophisticated and customized advice.

The Wealth Management Landscape with Bill Woodson

"We focus on the three main verticals: the independent Registered Investment Advisors, the brokerage firms, and the banks. I've also added, given my background and the increasing focus and relevance, family offices." Bill Woodson, Executive Vice President and Head of Wealth Advisory and Family Office Services at Boston Private, has 30 years of experience advising wealthy families, closely-held business owners, and family offices across a wide range of wealth management disciplines, including investment management, taxation, estate planning, philanthropy, wealth education, and family office best-practices, teaches The Wealth Management Landscape.

The Wealth Management Landscape course examines the opportunities and challenges in the wealth management profession, including its history and evolution, and analyzes how key trends (including the intersection of technology and wealth management) are shaping its future. Students will compare and contrast the various business models/platforms, including the professional characteristics of their respective advisors, and identify the unique attributes of each client-planner relationship. This course also explores the services that advisors are offering, across different client segments, to provide a full suite of solutions. As students evaluate the wealth management business models/platforms, leaders across the profession serve as guest speakers to provide unique insights and practical context. In addition, students will examine the emerging role and function of family offices, their different archetypes, the scope of services they offer, organizational and behavioral characteristics, and learn best practices in working for and managing family offices.

Learn more about the courses in Columbia's Wealth Management program.