A longtime resident of Montana, Jay Cochran has a rich background in agriculture. His first steps toward starting his insurance business was selling his rodeo horse to buy a laptop and earning an M.B.A. to better understand how to run a business. Seventeen years into his farm bureau insurance practice, Cochran decided to apply to Columbia’s Insurance Management Master of Professional Studies (M.P.S.) program. He did this to challenge himself, expand his knowledge, and to stay ahead of disruptive technologies. Since enrolling, Cochran has developed a close rapport with his cohort and says his professors provide an atmosphere for engaging conversations while understanding students’ balance between work life and academia.

How did you get your start in the insurance industry?

I was a teacher for five years before I started selling insurance. I actually went into farm bureau to buy a life insurance policy. One of the of the students I was teaching at the time, his father was a manager over hiring for the state of Montana. He asked me, ‘Why don’t you come sell insurance?’ I have a strong background in agriculture, and we are the number one writer of farms and ranches in Montana and Wyoming. So that was a pretty natural fit for me.

What are some disruptive factors you are seeing in the insurance industry?

I think technology in general and how we communicate are driving some of the most noticeable changes to insurance. For example, people no longer listen to the messages on their cell phones. So at my agency, we looked for two-way texting software that we could text from our main number. Outgoing texts show up as our main number. The incoming reply or text shows up for multiple staff members. Our staff receives an alert when this happens. This increased our ability to get messages back from our clients and partners so much more quickly than via telephone or email.

Also, further addressing efficiency, one of the first policies that I wrote involved me driving many miles to a ranch. I had dinner with the family and gave my proposal. I was there for hours. I took pictures of the ranch buildings to upload into a file for our underwriters. Our software at that time required eight hours to upload the photos. What used to take me hours, I can do in minutes now!

My first two clients were one of the guys I traveled with when I rodeoed and his brother. They were the catalyst for many more referrals. I learned word of mouth was my best advertisement. I would use each appointment as an opportunity to try to help someone by adding value. Even if they did not buy something from me, I would give them advice on how to move forward with whomever their carrier was."

How did you hear about Columbia’s Insurance Management M.P.S. program and why did you enroll?

I have an undergraduate degree in teaching agricultural education with a minor in biology. I enjoyed teaching and I always had an entrepreneurial spirit. When I graduated from college, I went to Cornell University and I did an apprenticeship shoeing horses. I rodeoed, taught school and put up hay and had a little ranch. But the insurance business was solid for me and it was something I was good at.

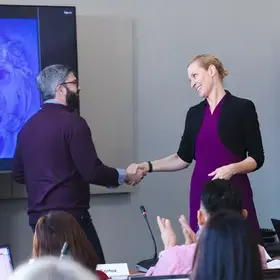

I decided to challenge myself further and dive into something more specific — a graduate degree in insurance. I had looked at other online programs, but I like the fact that at Columbia, we would meet and finish up the program with in-person residencies. I like the hybrid model. I also like the smaller cohort; I am learning and working with about 20 people. Finally, I would say the biggest benefit is the curriculum. I looked at the classes and thought every one of these directly applies to something I always wanted to learn, but haven’t had the opportunity to do so in the course of my day-to-day work.

It would take me decades to gain all the knowledge that I can get from the classes... every one of these directly applies to something I always wanted to learn, but haven’t had the opportunity to do so in the course of my day-to-day work."

Do you have a favorite course that has left a lasting impression on you so far?

I would say all of them. Each of the lecturers are successful in what they did and they want to give back to the program. It would take me decades to gain all the knowledge that I can get from the classes. The program has torn down a lot of barriers for me. You get an inside look at the industry as a whole. Barriers are erased and you get a bird’s eye view of the industry at large.

What has surprised you the most about your fellow students in your cohort?

It’s been fun to interact with everyone. We may vary by geographic location, age, sex, race or insurance specialization; however, I feel like we have cohesion through our morals, values, and vision. This generates a sense of belonging that will allow our cohort to maintain a bond throughout our professional and personal lives. This may sound surprising in an asynchronous and hybrid format, but the program design and group work facilitate a strong cohort relationship.