Mario A. González-Corzo, Lecturer of Finance, believes that economic models are an indispensable tool for teaching Finance. However, because the validity of all economic models depends on the thorough understanding of their underlying assumptions, students need to understand these assumptions to fully benefit from the insights provided by these models.

The valuation of financial assets using various approaches or methods (e.g. Discounted Cash Flows (DCF) valuation, fundamental analysis, technical analysis, etc.) is one of the principal topics covered in my Introduction to Finance course. Given its academic importance and practical applications across multiple industries or sectors, the study of financial asset valuation is quick to capture the interest of students, including those who are new to the field of finance. The valuation of debt securities, which represent the largest category of financial assets in the U.S. in terms of outstanding issues and market value, is of particular interest to finance students.

According to Benjamin Graham’s The Intelligent Investor (1973), the principal criterion that investors, market participants, and financial analysts should employ when applying fundamental analysis to bonds or fixed income securities is the number of times that total interest charges (for the bond issuer) have been covered by available earnings (or income) in a significant number of past periods. Graham (1973) is referring, in this case, to the “interest coverage ratio” (or “times interest earned” — TIE ratio), which my students in Introduction to Finance learn in the section of our course dedicated to financial statement analysis. The interest coverage ratio (or TIE ratio) is calculated as follows:

Interest coverage ratio = Operating income / Interest expense

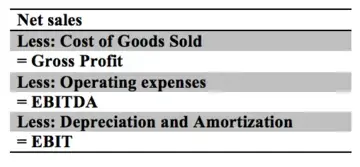

Some analysts also like to use the “EBITDA coverage ratio” — which basically replaces EBIT with EBITDA on the numerator of Equations (1) and (2) above. The reason for this adaptation is based on the idea that EBITDA provides a better indicator of a company’s earnings from operations.

The top portion of the Profit & Loss (P&L) or Income Statement shows:

Top portion of the Profit & Loss (P&L) or Income Statement

Clearly, the “EBITDA coverage ratio” provides a more accurate indication of the firm’s ability to generate adequate income from operations to “cover” its interest expense, excluding the effects of depreciation and amortization.

The Intelligent Investor (1973) provides a table (on page 148), listing the recommended minimum “coverage” for bonds and preferred stocks. While this table is obviously dated, and refers to issuers that no longer play a key role in the U.S. economy, the main points emphasized by Graham (in terms of bond valuation) are still valid. These can be summarized as follows:

- Investors can use these “coverage ratios” to assess the potential riskiness of a corporate bonds and preferred stock.

- It may just be that based on this metric (i.e. the “interest coverage” ratio or any one variation of it) investors may decide to pay more for a bond than what its DCF valuation would suggest.

Finally, in addition to the “coverage ratio” (or ratios), The Intelligent Investor (1973) indicates that several other metrics can be used to perform bond analysis. These include:

- Size of enterprise: Measured by the amount/volume of business conducted by the bond issuer.

- Stock/equity ratio: This ratio consists of the market price of the junior (or common) stock issues to the total face value of the debt (or bonds) plus the preferred stock. According to The Intelligent Investor (1973), this is “a rough measure of the protection, or ‘cushion,’ afforded by the presence of a junior investment that must first bear the brunt of unfavorable developments. This factor includes the market’s appraisal of the future prospects of the enterprise.”

- Property value: The Intelligent Investor (1973) indicates that “the asset values, as shown on the balance sheet or as appraised, were formerly considered the chief security and protection for the bond issue. Experience has shown that in most cases safety resides in the earning power [of the issuer], and if that is deficient, the assets lose most of their reputed value. Asset values, however, retain importance as a separate test of ample security for bonds, and preferred stocks in three enterprise groups: public utilities (because rates may depend largely on property investment), real-estate concerns, and investment companies.”

Based on anticipated or expected earning power [for the bond issuer], and on its stock/equity ratio, investors may also decide to pay more for a bond than what its Discounted Cash Flows (DCF) valuation would suggest.

The views expressed are those of the author and do not necessarily represent the views of any other person or entity.