Written by Perry Beaumont, Business Certificate Lecturer

In the midst of a historically turbulent year, Business Lecturer Perry Beaumont looks to the world of finance for answers about the nature of uncertainty.

With recent times certainly feeling rather uncertain, it got me to thinking about whether some kind of “uncertainty index” might exist that we could tap into for guidance about the nature of uncertainty and how we might better understand it.

Having worked and taught in the financial services sector for a few decades now, my mind naturally turned to how we think about modeling uncertainty in finance. In a word, we refer to it as “volatility”. In essence, volatility is a statistical measure that in its most basic form is calculated as an annualized standard deviation. The larger the standard deviation (meaning the dispersion of stock prices over time), then the greater degree of uncertainty that’s reflected in more erratic patterns.

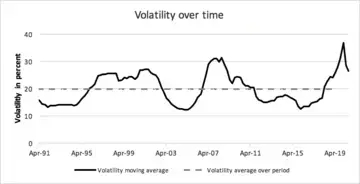

Figure 1: Volatility over time

Figure 1 (above) provides a chart of volatility’s behavior (with an 8-period moving average of quarterly data to help smooth things out a little), and we can readily see that over the past 30 years uncertainty looks to have had a tough time, consistently trending below 10%. Furthermore, we can observe that over this same period of time uncertainty has been quickly moving to rather high levels, as was the case during the Great Recession.

But why?

Why is it that with such dramatic advances in easily accessing data, as well as the ability to creatively analyze it, that we can’t seem to break below what looks to be a hard floor of uncertainty, or that we continue to see upward spikes? In short, how is it that practically no meaningful strides have been achieved in reducing uncertainty in the financial sector? The following are offered as potential explanations:

- Clarity and noise: When massive amounts of data are being accessed with greater ease, that bundle of information will likely contain both value-add elements as well as a large amount of clutter; both must be evaluated and sorted to get at the golden nuggets of what could represent a truly meaningful discovery.

- Unending questions: The ability to answer one question can give rise to entirely new questions.

- Entropy: A catch-all bucket that serves as a convenient way to explain away just about anything chaotic, from politics to the state of my son’s dorm room.

- Perhaps uncertainty is actually in decline: Perhaps we are indeed benefiting from less uncertainty with the application of analytical and other tools that have become available, but we’re simply not keeping pace with the rate of growth in new uncertainties.

My own personal vote would be in favor of option 2, although the correct answer could also be “all of the above” or other combinations of these considerations and additional factors. In reality, we don’t really know why uncertainty has not edged lower than its historical floor, or why it continues to reach so high.

And if that were not enough, even the manner in which uncertainty has been behaving over the past 60 years has also been characterized by changing dynamics.

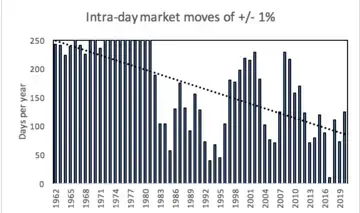

Figures 2 and 3 offer two ways that volatility can be further dissected.

Figure 2: Intra-day market moves of +/- 1%

Figure 2 (above) shows the number of days per year that the intra-day change in the S&P 500 was more than 1% up or down, and Figure 3 (below) shows the number of days per year that the day-over-day change in the S&P 500 has been more than 1% up or down.

Figure 3: Day-over-day market moves of more than +/- 1%

As we can see, the trend in Figure 2 has been for the magnitude of intra-day changes to edge lower over time, while the trend in Figure 3 has been for the magnitude of day-over-day changes to edge higher.

So, in the same breath that we might observe that uncertainty looks to perhaps at least have guardrails of sorts (as with a stable floor and a ceiling not likely to again be pierced above levels reached at the earliest stages of the pandemic), we need to additionally acknowledge that there are shifting dynamics below the surface. Uncertainty’s energy radiates both light (insights) and heat (risk) that are at the same time observable yet elusive.

As a student of finance, the study of uncertainty has taught me a great deal, and I suspect that it will continue to do so for years to come. While I still do not fully understand it, I embrace the inspiration it embodies to continue to push on and seek greater knowledge of how and why things sometimes appear beyond our comprehension. In summation, I believe there is a certain poetry to uncertainty, even though its rhyme and meter are ever-changing.

I’ve come to see uncertainty as something that ought not to accompany an exasperation felt at a road’s end when one answered question simply leads to three more being asked, but rather the counterpoint to a passion that fuels lifelong journeys along roads less travelled that made all the difference.

The views expressed are those of the author and do not necessarily represent the views of any other person or entity.