Mehreen Mahiuddin is no stranger to banking and entrepreneurship. She joined Citigroup in 2001 and went on to win a U.S. State Department Award for Excellence in 2004 as resident vice president and head of marketing and corporate affairs. Mahiuddin was also instrumental in building the company's brand presence in her home country of Bangladesh. After ten years at Citigroup and three children, Mahiuddin has returned to school to earn a Master of Professional Studies (M.P.S.) in Wealth Management at Columbia University.

Inspired by personalities like Jane Fraser of Citigroup, Soros Fund Management CEO Dawn Fitzpatrick, and Indra Nooyi of PepsiCo, Mahiuddin is pivoting her talents in service of her family business by building a fast-moving consumer goods (FMCG) company. She handles the banking relationships for its chemical and manufacturing wing and is preparing for a future position on the Board of Banks and in the insurance industry in Bangladesh. She spoke with us about what she’s learning as a part-time online student and how the skills and contacts she’s developing are helping her to achieve her career goals.

Tell us about your current role and responsibilities.

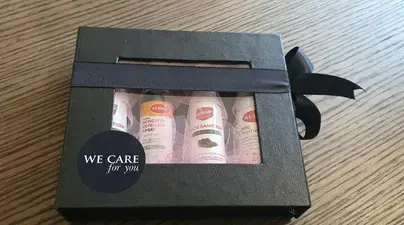

I am currently working as a director of my family business AMZ International, which is a local consumer goods company based in Bangladesh offering home and personal care products. In this role, I have several responsibilities: to create and scale up the company; look after the group’s asset management, investment portfolio, wealth transfer, and tax issues; and conduct work for the Hosne Aziz Foundation, the business’s philanthropic organization that offers free education to young children, free classes on information and technology, free health care and medicine for impoverished individuals, and a small hospital for emergency treatments. The nature of running a family business means I am also faced with challenges that constantly require me to take an active role in managing the family office and resolving regulatory matters on banking and insurance.

Samples of AZM International products and a set of products distributed for Qatar Airways

Why did you decide to enroll in Columbia’s Wealth Management M.P.S. program?

To reach my career goals, I knew I would need to expand my knowledge and skills in finance. In seeking ways to advance, I found the Columbia Wealth Management M.P.S. program. The program provides a holistic approach to wealth management and prepares me for the Certified Financial Planner (CFP®) exam. It also offers me the opportunity to interact with Columbia’s amazing faculty and top industry leaders who are addressing current issues. This master’s degree is helping to diversify and further develop my financial skills–from investment planning and the analytical skills needed for tax and investment planning, to insurance and retirement planning. I’m gaining a deeper understanding of wealth management overall as well. I believe all of these things will help me to attain my goals and take my career to the next level.

In addition, the skills I’m obtaining through the program complement my 15-plus-year career in banking and entrepreneurship. With my global expertise, I can explore the landscape of the wealth management industry, asking the right questions and strategically thinking about how the industry will grow in Bangladesh. I plan to provide a road map for successfully guiding our family business through a holistic and sustainable approach to wealth management. I’d like to address cross-border transactions with the right legal and compliance framework; learn how to get equity investment and IPO in the future; help secure possible foreign venture capital investments; implement paperless onboarding, next-gen reporting, legacy retirement, and impact investing; offer unique wealth management services and a special digital platform for banking businesses in wealthy countries; and ultimately address new competitive patterns.

Tell us about the wealth management industry in Bangladesh.

I found that the wealth management skill set can be beneficial in potential industry growth in Bangladesh. According to the New York–based research firm Wealth-X, among the fastest growing countries in the world in 2019, Bangladesh ranked third, with a projected increase of 11.4 percent in the number of ultra-wealthy citizens, defined as those with $30 million or more in net assets (ultra-high net worth/HNW), from 2018 to 2023. The wealth management offerings are still at a very nascent stage, though, where clients need to learn different aspects of tax planning, insurance planning and investments, estate planning, and wealth transfers. That also explains the exploding demand for a wealth manager not only in Bangladesh but across the globe—which has prompted me to invest in myself to further my career goals.

How do you ensure that you’re getting the most out of this online M.P.S. program?

As a student based outside the U.S., my Columbia experience has been extremely enriching. The online program allows me to actively participate during office hours; go through the resources; organize myself and set priorities with work and study hours; interact with study groups and with faculty through one-on-one Zoom meetings; make the best use of project-based learning; and leverage my network. I like going through each classmates’ discussion posts in the modules to understand different perspectives from people with extensive wealth management experience. I am also a vice president in the Wealth Management Club for students. I create learning and development events such as fireside chats with industry leaders and foster camaraderie and collaboration among Wealth Management students, faculty, and alumni.

What is it like being an internationally-based student in this program?

This online master’s program is ideal for international students because we can best benefit from asynchronous classes, online sessions, events, and group work. I haven't missed out on anything other than physically being on Columbia’s campus. I am looking forward to visiting the campus during the on-campus residency in December. Above all, my global and diverse classmates and lecturers have been extremely welcoming. Many have gone out of their way to schedule meetings that work well within my time zone (10 hours ahead of Eastern Daylight Time). They also provide assistance, widen my perspective on different issues, and help me learn and enjoy new experiences and skills that will go a long way.

Do you have any advice for prospective students?

This is the Ivy League. As this is an intense program, you should be prepared to dedicate yourself and spend at least 14 to 20 hours per week going through online resources, attending office hours, and getting the most out of the lectures and discussions. When you do that, you can apply what you’ve learned right away. Although this program is challenging, it’s definitely worth the journey and thoroughly enjoyable! You are literally receiving millions of dollars worth of advice from the world’s top wealth management experts and faculty during the 16 months you’re enrolled as a student, and even more as a graduate.