McKay Simmons has been an insurance broker for years, gaining valuable knowledge and insights through experience, mentors, and peers in the industry. Currently a Vice President in Marsh’s cyber practice, Simmons knows firsthand the risks and opportunities that digital disruption poses in insurance. He is a part-time student in Columbia’s Insurance Management M.P.S. program and co-founder of the university’s new Insurance Management Club. Now halfway through the program, Simmons is reflecting on his experience at Columbia so far.

Tell us about your career.

I am currently a Vice President in Marsh’s cyber practice. My responsibilities vary and are tailored to each insured organization that I work with, however, my duties typically entail advising clients regarding cyber and technology errors & omissions insurance. Fortunately, Marsh has — and continues to develop — a wide array of proprietary tools that assist us to best address each insureds particular risk profile and advise accordingly. Given the evolving threat landscape, it is more important than ever to make informed, strategic decisions. While this is true in many areas of the industry — as has been made abundantly clear with many high-profile cyber events and the quick-changing regulatory environment — this is particularly true of cyber insurance. There can be little doubt that cyber is the risk du jour and that it is one that organizations must pay attention to and continuously prepare for.

Given the evolving threat landscape, it is more important than ever to make informed, strategic decisions… This is particularly true of cyber insurance.”

If you could select one emerging topic or challenge that drove you to pursue a master's in insurance management, what would it be?

In my career, I have always worked as a broker. That being said, I wanted to have a more macro or holistic view of the industry. My decisions and understanding of the industry thus far have been informed by my own experiences, by the thoughtful and generous guidance that I have received from incredible mentors, and by listening to leaders of the organizations that I’ve worked for. That being said, I wanted to expand on these and to further develop my own understanding. Taking classes like Claims Management, Underwriting, Finance in Insurance, and Product Pricing & Distribution have done just that. I learned a great deal from these courses. The courses that I’m taking now are also broadening my view and pushing me to grow. I have no doubt that the upcoming courses will also help me continue on this path and achieve the objectives that pushed me towards this degree initially.

Why did you enroll at Columbia, specifically?

When deciding on which degree to pursue, there were a number of factors to consider. I wanted to learn from experienced, industry leaders. The Columbia degree provided that. I wanted to expand my knowledge base and knew that the courses, that were carefully selected to be part of this program, would provide that. I needed a degree that was flexible enough to allow me to continue working in a demanding job, but still provides in-person interactions and a collaborative environment in which I could interact with the other members of my cohort. Finally, it was always a dream to be able to call myself a Columbia Lion.

It is my belief that the cohort was carefully and thoughtfully selected. There are brokers, underwriters, agency owners, etc… it is stunning how willing people are to collaborate, share, and coordinate.”

What has surprised you the most about your student cohort?

I was pleasantly surprised when I met my cohort. It is my belief that the cohort was carefully and thoughtfully selected. There are brokers, underwriters, agency owners, etc. We have such a diverse breadth and depth of experiences and an incredible range of insights to draw from. In addition to learning from our program director, professors, and guest lecturers, I am continuously growing thanks to the interactions that I have with the other members of the cohort.

It has been incredible to work alongside a cohort of this caliber. Each of us is on our own journey and pursuing individual growth, but it is stunning how willing people are to collaborate, share, and coordinate. Each of us wants to grow. Each of us wants to learn. Most importantly, I believe each of us wants to have a positive impact and foster progress in this industry that we have each gravitated towards in our own ways.

You’re now halfway through the Insurance Management curriculum. What’s been the most interesting course so far and why?

I have learned a great deal from each of the courses that I’ve participated in, so it is difficult to pick one that is the most interesting. That being said, there was one final project that really stood out to me. There were elements that we drew from both the Role of Finance in Insurance course and the Product, Pricing & Distribution course. Each student was tasked with creating an all-new insurance product. It could draw from current coverages, but needed to be something that wasn’t currently in existence. I found this project to be a fascinating way to take the theoretical and academic principles we had begun to master and to mold them into something tangible and real.

How have you adjusted your work strategies since enrolling?

I have absolutely begun implementing the knowledge I’ve gained from the courses taken thus far. I have found myself in meetings or strategizing about clients’ needs and found myself utilizing something that I learned from a reading assignment, a lecture, or an interaction with a team member.

Outside of the coursework, how are you staying engaged with the wider Columbia community?

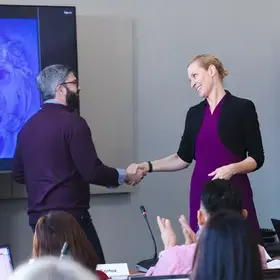

At Columbia, the program is designed to fully integrate engagement with faculty, classmates, and industry experts. But there are countless other ways to engage with the broader Columbia community as well. If you feel that something is missing, you are free to create your own as well – all with the benefit of having access to Columbia’s resources and network. For example, I, along with another member of my cohort, Karl Susman, founded the Insurance Management Club at Columbia. While the club is specific to insurance, the events are not. We have created an inclusive environment in which we try to involve members of the cohort, the faculty, and the Columbia community as a whole. Our events are broadly shared and we genuinely hope that our fellows Lions won’t hesitate to join us. Our club is new, but we feel fortunate to have had stronger than expected interest and support as our meetings have progressed.