Academics

Start building your summer.

Focus Areas for Visiting Students

Thematically linked courses of study designed to cover four different areas of scholarship. Our unique interdisciplinary approach offers students the opportunity to study across multiple departments, crafting a curriculum that aligns with their interests and goals.

Learn more

Certifications of Professional Achievement

Pursue a subject of interest for career development or advancement in International Relations, Human Rights, or the United Nations.

Learn more

Certificates

Certificates offer focused, advanced study that can be as intensive as a degree program. These flexibly scheduled programs are appropriate for graduate school preparation and career advancement.

Learn more

Arts in the Summer

The School of the Arts offers courses in Film, Theatre, Visual Arts, and Writing, taught by renowned professors who are experts in their field.

Learn more

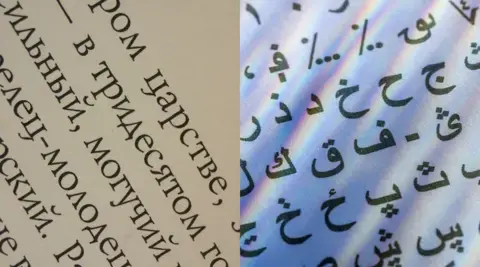

Special Foreign Language Programs

Six-week foreign language programs in French, German, Greek, Italian, Latin, and Spanish are available, as well the four-week concentrations: Arabic Summer Program and Russian Practicum.

Learn more

High School Student Programs

Enjoy your summer with events, special activities, and co-curricular activities while staying sharp with challenging courses.

Learn more

English Language Study

Improve your English, build community, and experience campus life in New York City this summer.

Learn more